You are currently browsing the category archive for the ‘homeowner tips’ category.

Let’s face it. No matter how large your Southern Maryland home is, storage always seems to be an issue at one point or another. You don’t always have to do a major renovation to increase your kitchen’s storage space. Here are a few clever ideas on how to add storage to your kitchen without adding square footage.

Let’s face it. No matter how large your Southern Maryland home is, storage always seems to be an issue at one point or another. You don’t always have to do a major renovation to increase your kitchen’s storage space. Here are a few clever ideas on how to add storage to your kitchen without adding square footage.

Cabinets – That area between the top of the cabinets and your kitchen ceiling tends to be dead space where tchotckes are left to gather dust. Cabinets that are in good shape can be moved so that they kiss the ceiling. Add a nice, open shelf underneath them so that you can keep items you use everyday within easy reach. The shelf makes a great place to store your cookbooks, spices, measuring utensils and anything else that usually takes up room on your countertops. Reusing your old cabinets saves you money as well. Crown molding at the top can finish off the look quite nicely.

Kitchen Island – Usable surface area is another scarcity in many Southern Maryland homes. Make use of the “dead” area in the middle of your kitchen by installing an island. Cabinets, cubby-holes and open shelving helps you create extra storage, too. A portable island is great for smaller kitchens. Roll it out when you need it and neatly store it away when you’re through.

Pot Racks – Stop searching through cabinets to find your saucepan. Hang a pot rack above your sink, kitchen island or wherever is convenient. Using a pot rack with shelving on top makes for even more storage space.

Closets – Many Southern Maryland homes have a handy closet located in or near the kitchen to store brooms, mops and other cleaning items. Take out the brooms, add some shelves and you’ve got a ready made pantry. Moving food items from your cabinets into your new pantry makes more storage area for dishes, pots and pans.

As you can see, adding storage to your Southern Maryland kitchen doesn’t have to involve extensive or expensive remodeling efforts. You can work with what you have to make it even better!

Bonnie Augostino, your Southern Maryland real estate specialist

Originally posted on my Southern Maryland real estate blog here: http://activerain.com/blogsview/3014729/adding-storage-to-your-kitchen.

Decorating is one of my favorite things of the holiday season. Everything is so shiny and beautiful, including the Christmas tree. According to the US Fire Administration, however, fires during the holiday season account for 400 deaths, 1650+ injuries and almost $1 billion in damages every year. Here are a few Christmas tree safety tips to help you and your Southern Maryland home avoid becoming one of these statistics.

Decorating is one of my favorite things of the holiday season. Everything is so shiny and beautiful, including the Christmas tree. According to the US Fire Administration, however, fires during the holiday season account for 400 deaths, 1650+ injuries and almost $1 billion in damages every year. Here are a few Christmas tree safety tips to help you and your Southern Maryland home avoid becoming one of these statistics.

Choosing the Right Tree – This is the first step in preventing a fire in your Southern Maryland home. Choose a tree that is freshly cut. To check for freshness, make sure that the needles are green and bend easily. Brittle needles mean that the tree is already dry. Pick up your tree and bounce the trunk on the ground to see how many needles fall off. There will always be a few that come off, but, if there are a lot of needles on the ground, that means the tree was cut too long ago and has begun to dry out.

Maintaining Your Tree – Keep your Christmas tree away from all heat sources (fireplaces, heating vents, portable heaters) as these will dry your tree out quickly. Check the water reservoir every day or two to maintain the water level. The USFA recommends that you don’t leave your tree up for longer than two weeks. After two weeks, the potential for your Southern Maryland home to catch fire increases significantly.

Decorations – Check your holidays lights for frayed wires, broken insulation or anything else that could create a fire hazard. Only use lab tested lights that are approved for indoor use. Beware of overloading electrical outlets. Use a multi-socket adapter or power strip if you need more than two outlets. Don’t link more than three strands of lights together. Never decorate your tree with lit candles. Always turn lights off when you leave the house or go to bed.

Proper Tree Disposal – Dry wood and needles burn extremely quickly. Never burn them in your fireplace or wood-burning stove. Instead, take it to your local recycling center or check with your local garbage collection agency to see what their pickup requirements are. All dry trees should be taken down and disposed of right away.

Artificial Trees – Look at the box to make sure it is a flame retardant tree. Only use Christmas tree lights that are approved for indoor use. Periodically check the lights for heat output. Hot lights could melt the tree.

Follow these Christmas tree safety tips to make sure your family celebrates the holidays danger free. Happy holidays, everybody!

Bonnie Augostino, your Southern Maryland real estate specialist

Originally posted on my Southern Maryland real estate blog here: http://activerain.com/blogsview/2635165/christmas-tree-safety-tips.

If you are among the throngs of homeowners who are facing the possibility of foreclosure, you know how stressful a time this can be. There are some steps you can take to help make this a bit easier. Here are some helpful tips for homeowners facing foreclosure.

If you are among the throngs of homeowners who are facing the possibility of foreclosure, you know how stressful a time this can be. There are some steps you can take to help make this a bit easier. Here are some helpful tips for homeowners facing foreclosure.

- When your lender calls you, don’t ignore it. Make sure to return any phone calls promptly. Lenders are more likely to work with you if you are honest and up front with them rather than avoiding them altogether.

- Life changes can affect your finances. The loss of a job, a spouse, extended illness or a divorce can make it harder to make your mortgage payments. This would be the time to talk to your lender.

- Creating a budget that changes as your financial situation changes is smart. By keeping an eye on how much money is coming in and how much is going out in bills, you may be able to see ways to cut spending and focus more on necessary expenses. If those credit card bills or car payments are getting hard to make, it will only be a short time before your mortgage payment is affected as well.

- Don’t be afraid to call your mortgage company. When you see that money is getting tight, rather than waiting for your lender to call you, be proactive. Call them. More likely than not, they will be willing to find a way to work with you or look for a program to help you. They don’t want to have to take your home back from you any more than you want to give it to them.

When you do speak with your mortgage lender, make sure you are as honest with them as you can be. Explain your situation, ie, job loss, extended illness, death of spouse, etc. and how this has affected your finances. Some options to discuss with them include refinancing your home loan, paying a lump sum to get caught up (if possible), asking if they can issue a forbearance (where they temporarily reduce or possibly even temporarily halt your payment to help you get caught up), loan modification or repayment plan.

As always, beware of foreclosure scams. If a company requires you to pay them money up front to help you with your foreclosure, they are most likely a scam. Lenders don’t require payment for foreclosure help. Don’t let your stress and desperation make you fall victim to a scammer.

By following these tips for homeowners facing foreclosure, you can. hopefully, make a bad situation better. Let me know if you need help with your Southern Maryland real estate. I’m happy to help!

Bonnie Augostino, your Southern Maryland real estate specialist

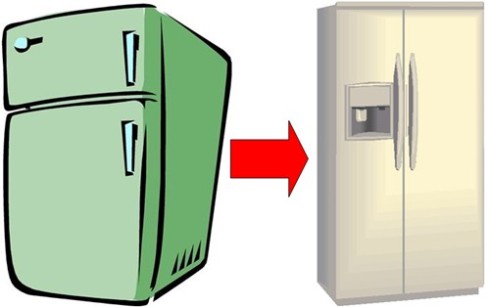

A sort of “Cash for Clunker Appliances” program will be in effect in Maryland starting April 22, 2010. The Maryland Appliance Rebate Program (MARP), as it is officially called, allows all Maryland residents a rebate on new energy-efficient appliances that replace old appliances. You will have to give proof, however, that you are not simply storing away the old appliance for use elsewhere, such as using the old refrigerator for cold food storage in the garage. The MARP is meant to replace the old, outdated, energy draining appliances of old to help ease both energy use and wear and tear on Mother Earth. The MARP rebates are available in addition to local utility rebates already in place from Allegheny Power, BGE, Choptank Electric Cooperative, Delmarva Power, PEPCO and SMECO.

Not all appliances qualify. However, even if an appliance doesn’t qualify with the local utility, it may still qualify with the Maryland Appliance Rebate Program. To find out if a particular appliance qualifies, please read the guidelines from the Maryland Energy Administration. Purchases made before April 22, 2010 do not qualify. Proof of purchase will need to be provided for all rebates.

If you have an old clunker in your Maryland home that needs to be replaced, you may want to consider using Maryland’s answer to the “Cash for Clunker-Appliances”, the Maryland Appliance Rebate Program. You can get rid of an old energy-guzzler, bring in a brand new energy-efficient model and get some money in the process. Who wouldn’t love it?

Governor O’Malley has declared April to be Environmental Education Month through out the state of Maryland. April is also the month the world celebrates Earth Day. Since April is a very green month in Maryland and because everyone is looking for ways to save money these days, I thought I would share with you a way to do both.

You can get a $25 discount coupon from the State of Maryland when you plant a tree costing $50 or more. You can get your $25 coupon on the newly created Marylanders Plant Trees website. Marylanders Plant Trees is the website which promotes citizen, community and business participation to plant 50,000 trees by 2010. The State of Maryland has committed to planting one million trees of its own by 2011. The website also offers advice and tips on how to select your tree and a recommended tree list.

Trees not only improve our environment, they also beautify our neighborhoods, add curb appeal to homes and add to property values. In addition, trees can reduce your energy costs by as much as 35%. After you have printed you coupon and planted your tree, you will want to return to the Marylanders Plant Trees website and register the tree. An interactive map showing all the newly planted trees will be added to the website sometime in the future.

You can go green, celebrate Earth Day, learn more about your local environment, improve the environment, add to sustainable living and help your state meet its goal all by just planting a tree while saving money at the same time!

Bonnie Augostino, Southern Maryland’s Real Estate Professional, The Difference Is Crystal Clear

Related Links:

Marylanders Plant Trees – Cooperating Vendors

Marylanders Plant Trees – Tree Benefit Calculator

Maryland’s Environmental Education Department

Citizen Environmental Participation

April Proclaimed Environmental Education Month

Before I begin, let me say Happy Saint Patrick’s Day to all the beautiful Irish out there and to all the Irish by default (everyone is Irish today). Now, back to the meat of the matter. Stimulating the economy and the housing market are hot topics in today’s economic world. I thought I would share a few things that may help to stimulate the Southern Maryland real estate market.

Tax Credit – First-time Buyers:

* The tax credit is for first-time home buyers only! If you have not owned a home within the last 3 years, you qualify as a first-time home buyer.

* The tax credit may only be applied to homes that will be your principal residence.

* The tax credit does NOT have to be repaid. The tax credit of 2008, however, must be repaid.

* The tax credit is not $8,000 but is equal to 10% of the home’s purchase price with a maximum of $8,000.

* The tax credit applies only to homes purchased on or after January 1, 2009. Escrow must close no later than November 30, 2009.

* The tax credit income limits: married couples income limit is $150,000 and single taxpayers income limit is $75,000.

* The tax credit has an income limit phase out: for those who exceed the income limit, there is a smaller tax credit. The tax credit is dependent on the adjusted income. Please consult with a tax professional to see if you would qualify.

* The tax credit will be applied to your 2009 taxes. Sometimes, the tax credit can be applied to your 2008 taxes. Consult with a tax professional as to how the tax credit will best benefit you.

* The tax credit is refundable. If the taxes you owe are less than the tax credit, the difference will come to you in the form of a tax refund.

Tax Credit – Homeowners

* Tax credit applies to homeowners making energy efficient improvements to their principal residence.

* Tax credit limit is 30% of the cost of the improvement(s) up to $1,500. $4,500 in improvements equals a $1,500 tax credit.

* Tax credit applies to energy improvements, such as insulation, water heaters, doors, windows, heating and air systems.

Reverse Home Mortgage Loan Limits

* Loan limits for FHA-insured reverse mortgage loans was increased to $625,000.

* Senior citizens can buy a new home (with equity) with a reverse mortgage loan without having to sell their current home.

Conforming Loan Limits Restored

* The maximum loan limit for high cost areas has been restored to $729,750.

Homeowners Refinance Program – Not Behind In Payments

* Homeowners who have less than 20% equity may refinance their loan.

* Homeowners may refinance up to 105% of their home’s current value.

* Refinanced loans will be refinanced at the prevailing interest rate and terms at the time of the loan. Currently, loans are hovering near 5%.

* Refinance options include a 15- or 30-year fixed rate option.

* Refinance loans are intended to lower your payment with a lower interest rate; it will not lower your principal balance or waive any debt.

Homeowners Refinance Program – Behind In Payments

* Only applies to the homeowner’s principal residence.

* Multi-family units may qualify if one of the units is owner-occupied. Please consult with your tax adviser.

* Applies only to first mortgages.

* If a property has a second mortgage, the homeowner can still qualify but cannot refinance the second loan under the refinance program.

* Loans must be backed by Fannie Mae or Freddie Mac.

* Loans may not exceed current loan limits.

* Principal loan balance may be lowered with approval by the lender.

* Homeowners may earn a tax credit. The homeowner must stay in the home for five years. The maximum tax credit is $5,000.

The information above is a short summary of the various programs and is intended to be straight forward. However, there may be other qualifying factors.

Bonnie Augostino, Southern Maryland Realtor

New guidelines for funding new septic systems for eligible homeowners have been approved by the Calvert Board of County Commissioners. The grants are funds which are available for homeowners to replace failing septic systems. In the past, all homeowners in environmentally sensitive areas, the Mill Creek watershed and areas 1,000 feet from tidal wetlands or shorelines received priority consideration. Under the new guidelines, homes that have been assessed at less than $250,000 and/or are occupied throughout the year will now receive priority.

The funds for the grants to Maryland homeowners are received from the Bay Restoration Fund. This year, Calvert County received $1.6 million in funds for the program. Available funds will pay for about 95 new systems. 125 homeowners have applied for a grant.

Failing septic systems cause approximately 25% of the nitrogen pollution in Calvert County’s waterways. In the Mill Creek area, that figure doubles. Nitrogen from failing septic systems can seep into the waterways. This seepage causes algae blooms, which kill off fish and other water dependent life.

The funds for the Bay Restoration Fund are received from the “flush tax”. The “flush tax” was imposed to help programs which protect the Chesapeake Bay and is tributaries. Homeowners on sewer pay a monthly sewer fee. Homeowners with septic systems pay a yearly assessment fee. The “flush tax” monies are collected by the county and given to State of Maryland. The state then distributes the funds to various projects that lower nitrogen discharge. As well as assisting homeowners replacing failing septic systems, monies are also directed to farmers which plant cover crops; the cover crops reduce nutrient runoff into the waterways.

For more information on this and any help with your South Maryland real estate, please feel free to contact me.

With beautiful Spring weather headed our way,

With beautiful Spring weather headed our way,